Stock market volatility prediction using VAR-ML hybrid model

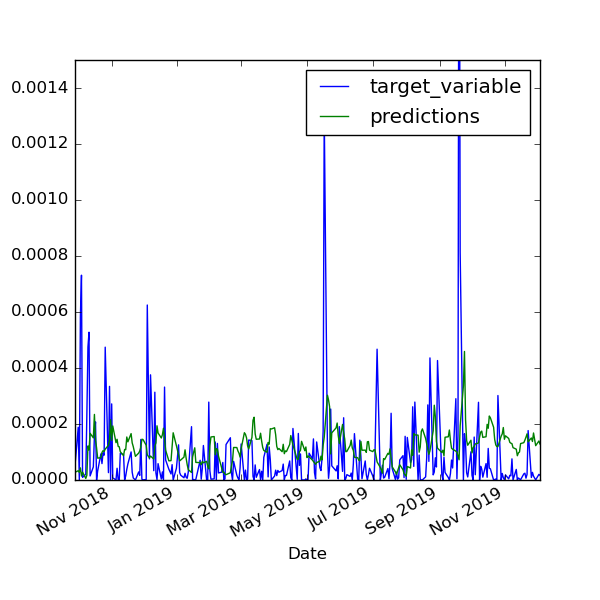

The study uses basic LSTM, GRU LSTM and bi-drectional LSTM models to compare the predictions made by two different data sets (Training period: 2008-2019; Test period: 2019-2020).

- The first dataset:

- Input data: Indian stock market volatility; US, UK, Japan, China, Singapore, Hong Kong daily market data

- Target Variable: Next day volatility of Indian stock market

- The second dataset:

- Input data: VAR residuals for VAR fitted on India and each of the other six countries individually; Indian stock market volatility; US, UK, Japan, China, Singapore, Hong Kong daily market data

- Target Variable: Next day volatility of Indian stock market

VAR residuals contain information about the response of a variable to an unexpected shock in the other variable. The other six countries were chosen as contributing variables since the nations are mostly developed or have a high volume of trade with India.

The hybrid model showed improved accuracy and increased sensitivity to market shocks, proving the effectiveness of the hybrid model and the usefulness of residual data in volatility prediction.

Best Performance: Bi-directional LSTM with the second dataset (Hybrid Model): RMSE = 0.00018