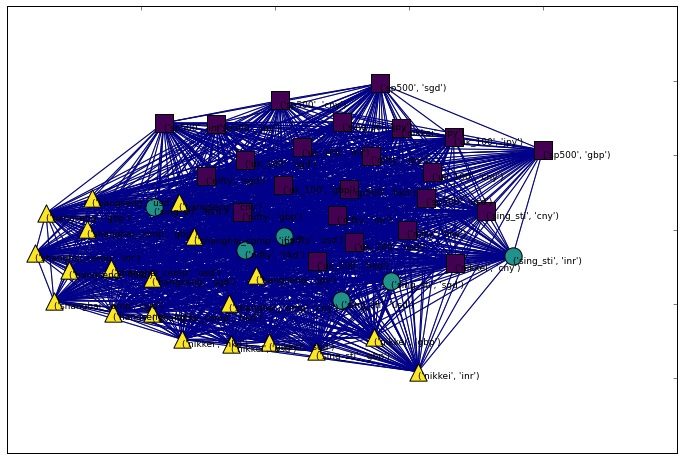

Community analysis of International stock markets

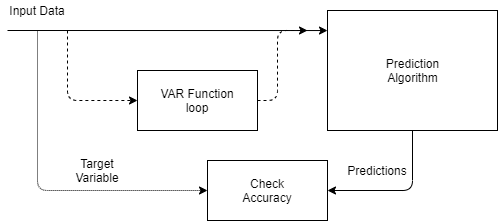

Study focused on exploring community dynamics over the period of 2008-2020. The countries, whose stock markets are analyzed are India, Japan, China, Singapore, Hong Kong, US & UK. Networks are significantly important for policy makers and investors too, since it enables an analysis of the group behaviour of the markets, which is a major aim of the study.

Status: First draft completed. Under review by a journal