Project PINAKA

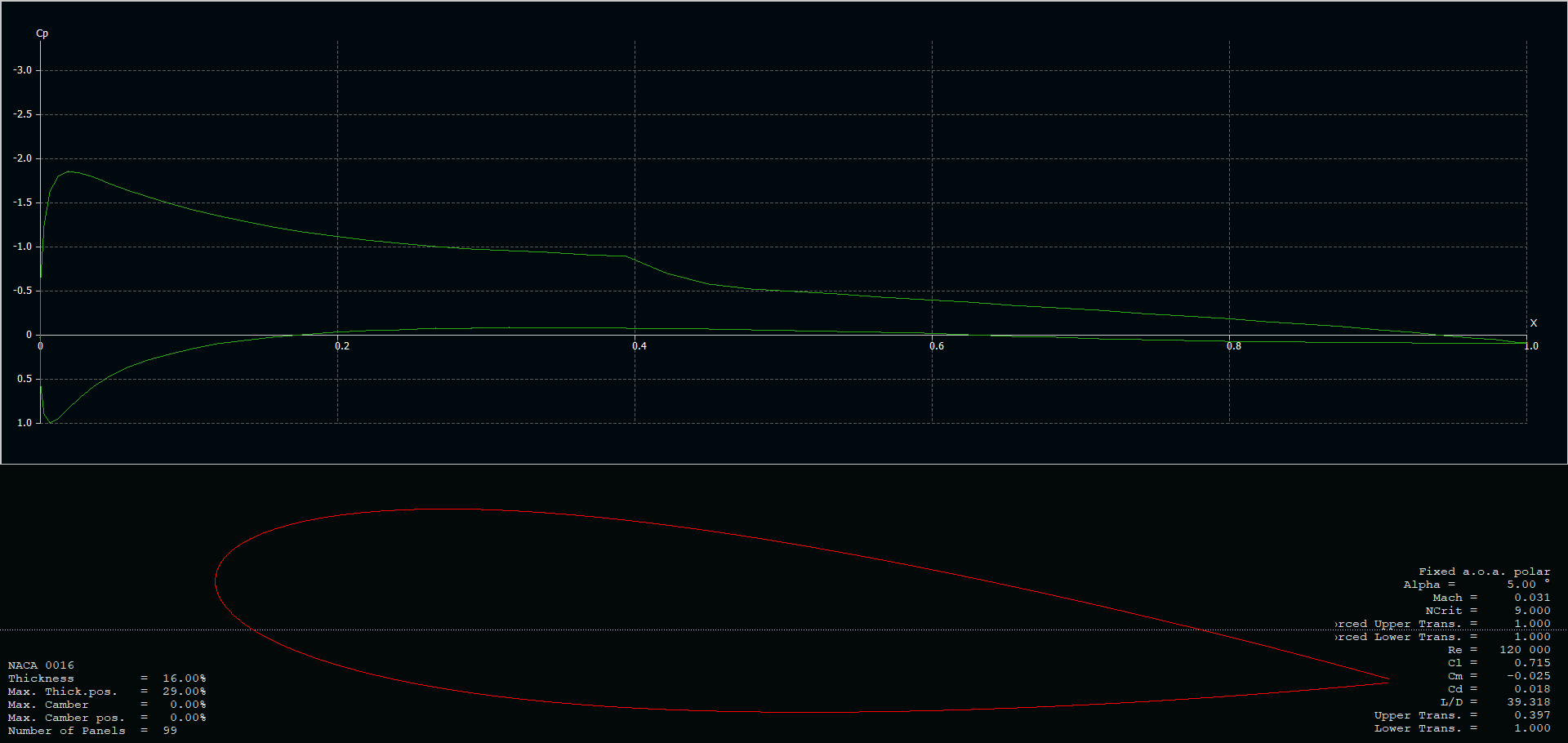

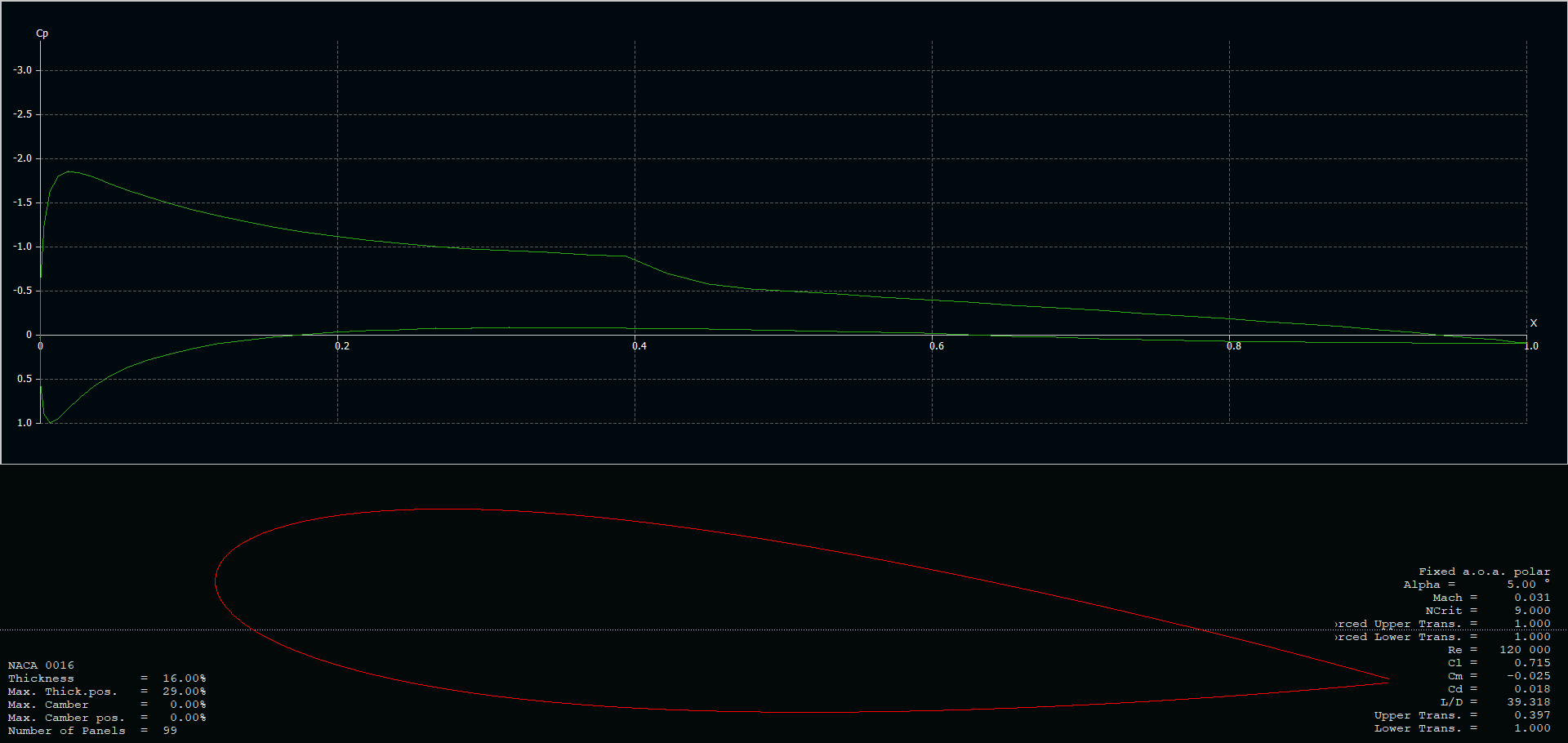

Replication of the ALOFT project, to generate an automated flight path generation algorithm, to maximize efficiency.

Status: Prototype complete. Project Shutdown.

Replication of the ALOFT project, to generate an automated flight path generation algorithm, to maximize efficiency.

Status: Prototype complete. Project Shutdown.

Project under the supervision of INMAS lab, Delhi, focused on Human Machine Teaming. Aim was to develop a multi-nodal system which could control a swarm of drones.

Status: All requirements for phase 1 completed. Project shutdown.

Published in Journal 1, 2009

This paper is about the number 1. The number 2 is left for future work.

Recommended citation: Your Name, You. (2009). "Paper Title Number 1." Journal 1. 1(1). http://academicpages.github.io/files/paper1.pdf

Published in Journal 1, 2010

This paper is about the number 2. The number 3 is left for future work.

Recommended citation: Your Name, You. (2010). "Paper Title Number 2." Journal 1. 1(2). http://academicpages.github.io/files/paper2.pdf

Published in Journal 1, 2015

This paper is about the number 3. The number 4 is left for future work.

Recommended citation: Your Name, You. (2015). "Paper Title Number 3." Journal 1. 1(3). http://academicpages.github.io/files/paper3.pdf

With increasing globalization, the links between markets have started to become stronger. As a result, markets now hold significant influence on other international markets. We study this effect by measuring the volatility transmitted from a market to another. Model used for analysis is the Multivariate GARCH model (BEKK(1,1))

Status: First draft complete. Under review by a journal

Based on the business cycle theory, every economic recession and expansion is just part of a cyclic process. Hence it is a fair assumption to treat different parts of the cycle as separate regimes, where the economy resides. Over the years bond yield has acted as a measure for investor sentiment and an indicator for recessions. We test the effectiveness of bond yields in predicting recessions in multiple countries, by using a modification of the model, which uses external regressors to calculate a time varying transition probability developed by Andrew J. Filardo in 1998. Below is the image of predictions made by the model for USA.

Status: First draft completed. Under revision

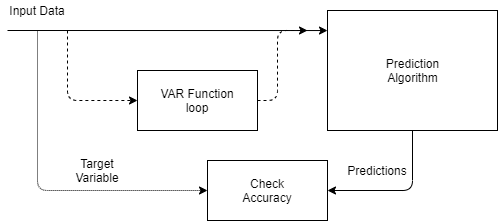

Volatility modeling has been an important part of financial modeling for a significant amount of time. Over the years GRACH model has been the go-to model for most analysts, since its explainable and robust. However, with the advent of machine learning, the accuracy of financial models has improved significantly. GARCH model uses the residual data from VAR or VECM models to capture information about unexpected shocks in the market. The aim of this study is to study the next-day prediction accuracy of RNNs, when the input data is the market volatility, as compared to, when VAR residual data is used additionally with market volatility.

Status: First draft completed. Under review by a journal

Increasing the explainability of fixed income portfolio returns using fixed income attribution. The study analyzes returns of three Indian fixed income portfolios to explain their returns and study changes over the first quarter of 2020.

Status: First draft completed. Under review by supervising professor

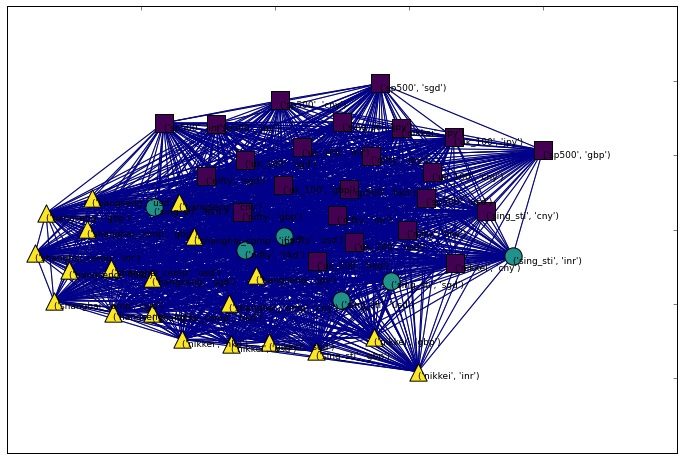

Study focused on exploring community dynamics over the period of 2008-2020. The countries, whose stock markets are analyzed are India, Japan, China, Singapore, Hong Kong, US & UK. Networks are significantly important for policy makers and investors too, since it enables an analysis of the group behaviour of the markets, which is a major aim of the study.

Status: First draft completed. Under review by a journal

Published:

This is a description of your talk, which is a markdown files that can be all markdown-ified like any other post. Yay markdown!

Published:

This is a description of your conference proceedings talk, note the different field in type. You can put anything in this field.

Undergraduate course, University 1, Department, 2014

This is a description of a teaching experience. You can use markdown like any other post.

Workshop, University 1, Department, 2015

This is a description of a teaching experience. You can use markdown like any other post.